What is a Purchase Order and How Does It Work?

Additionally, the supplier needs the PO to fill the order correctly. The buyer will also be charged by the supplier based on the payment terms agreed upon in the PO. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other.

- PO date is the date when the purchase order was created—NOT when it was sent to the seller or when the seller received it.

- For example, a bakery might need to order flour and other ingredients in bulk from a supplier.

- The document authorizes a supplier to deliver to the buyer at the price, quality level, delivery date, and certain other terms specified in the agreement.

- There is no need to include details about quantities or time frames in a CPO.

What is the purchase order process?

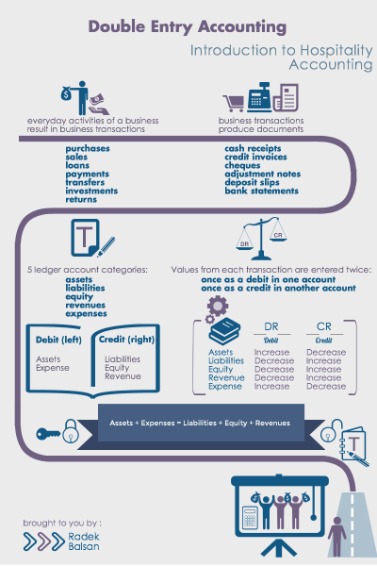

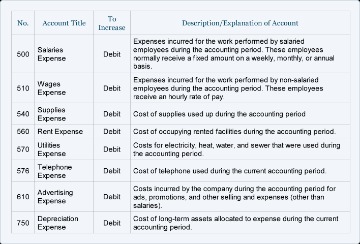

In the next step of the PO process, the vendor has the option to either accept or reject the purchase order. Once the seller accepts and signs the purchase order, it becomes a legally binding contract. If it’s rejected, the seller might ask the buyer to make revisions or the buyer might have to find a new vendor. In a purchase order, companies should clearly articulate what items or services they need, the price point, shipping terms, and the delivery date. This sets clear expectations of what needs to be delivered and serves as documentation for when a delivery doesn’t go as planned. Purchase orders automate workflows to streamline the approval and accounting process.

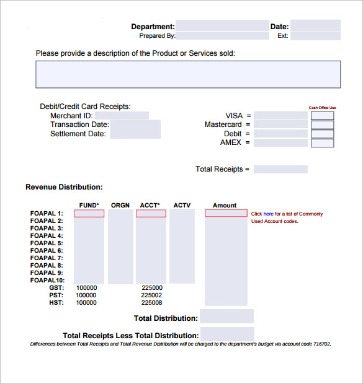

Delivery details

If you want to fully digitize past records, that can be completed simply too, through a straightforward process for uploading documents. Buyers are expected to pay the supplier according to the payment terms set out in the order itself. Generally, this means https://www.bookkeeping-reviews.com/ that buyers will pay the vendor after receiving an invoice for the purchased goods, though sometimes the seller may specify a payment deadline. Some sellers may request payment upon delivery, so make sure to check the terms before the date of delivery.

What is a Purchase Order (Meaning, Template, Example, Download)?

Additionally, the purchase order will specify the expected delivery date for the goods or services. This date is vital, as it helps both parties plan for the receipt and integration of the products into their operations. When the goods that need to be purchased are agreed upon, the purchase order is created. Non-PO invoices are created without following the standard procurement process of generating a purchase order or PO. These invoices need to be approved by relevant business approvers before processing. Suppose you need to restock your inventory with specific products you want to sell in your store.

Is a Purchase Order Legally Binding?

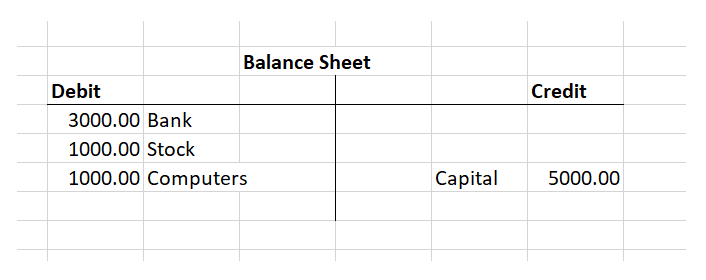

To take advantage of predetermined pricing, suppliers often allow multiple delivery dates over a period of time. It’s useful for businesses with complex organizational structures. If the business has several departments, POs ensure proper management of inventory ordered and accurate recording in the books.

Create a free account to unlock this Template

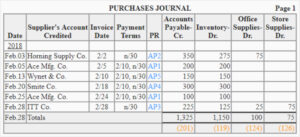

A purchase order for newly designed labels was issued and approved six weeks earlier. Before sending a purchase order, a buyer first needs to figure out what and how much they need to buy. A purchase requisition form is a document that the purchasing department typically fills out. This document allows companies to track their expenses and keep tabs on the items or services they ordered. PO numbers make it easy for both the buyer and the seller to keep track of delivery and payment.

Here’s an example of a purchase order form

When you receive a purchase order, prepare the order based on the terms and conditions. Receiving a PO from a customer starts the purchase order procedure. As a buyer, you need to know what information to include on a PO. For the sake of efficiency and simplicity, companies will also often set a lower cost threshold for issuing a purchase order. For example, your company might decide that it is most efficient if all orders smaller than $500 don’t use a purchase order.

The purchase department reviews the purchase requisition form, and if approved, prepares the purchase order. The buyer issues a purchase order for products they want to acquire from another party, such as a supplier. An invoice, on the other hand, is issued by the business or seller that is selling the product to another party, such as a customer.

This makes it easy to find a reference for a specific transaction later. Number would look on your invoice, you can try out free invoice templates that will help you create an invoice with all the information where it should be. FreshBooks invoicing software can help you create professional-looking invoices in seconds. If products are sold, an invoice is normally issued by the seller when the products are shipped. The sales invoice from the seller becomes the vendor bill on the buyer side.

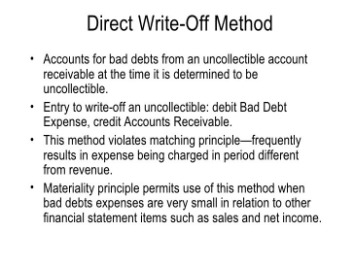

Once the seller receives the PO, they have the right to either accept or reject the document. However, once the PO is accepted, it becomes a legally binding contract for both parties involved. Most AP automation vendors automatically capture invoice data while assigning prepaid expenses meaning journal entry and examples GL codes and cost centers, matching invoices with POs and assigning approvers according to pre-set workflows. ClearTech’s AP automation software even allows business approvers to approve or reject invoices with a single click on their email or Slack accounts.

At the very bottom of every order form there is a signature line for the authorized manager to sign. So basically, an order includes everything about the transaction and what the buyer expects. On the other hand, you may receive POs from your customers, the buyers.