What Is QuickBooks? A Guide to QuickBooks Features & Pricing

For an additional $50 per month, Simple Start users gain on-demand access to a live bookkeeper who can guide you through basic bookkeeping and accounting functions. QuickBooks Simple Start includes free guided setup, though this feature isn’t available for users who choose the free trial. QuickBooks provides small businesses and entrepreneurs key financial management capabilities to run operations efficiently.

Top QuickBooks Online alternatives

Currently, QuickBooks is offering two different specials; you can either try it free for 30 days or sign up and get a 50% discount on your first three months. While there are many options available, you do not need to sign up for all of the QuickBooks services all at once. You can start with a single app, such as the accounting or payroll software, and add others as you expand. If you outgrow any service, you can choose to remove or upgrade it as needed. These apps work together flawlessly, integrating with QuickBooks accounting software to create a comprehensive accounting and payments ecosystem for your small or mid-sized business.

Choose the account type and detail type

We save you money the moment you hire us by cutting out the expensive cost of hiring an in-house CFO. You can download and get started after spending a couple of hours browsing through the different screens. You can take a printout of all the information your accountant needs to prepare the returns and ship it to them easily.

Employee Time and Expense Tracking

QuickBooks makes it easy to create invoices either from scratch or from an earlier estimate. QuickBooks has an accounting tool specifically for freelancers called QuickBooks Online Self-Employed, which starts at $15 a month. QuickBooks Self-Employed tackles basic freelance bookkeeping features like expense tracking, receipt uploading, tax categorizing, quarterly tax estimating and mileage tracking. QuickBooks Online Advanced is more than double the cost of QuickBooks Online Plus, which can make it an expensive jump for midsize businesses seeking to scale up. Still, the plan is extremely comprehensive and includes employee expense tracking, batch invoicing and 25 users. Advanced is the only QuickBooks plan to include free 24/7 customer service.

In the accounting field, accountants often encounter various challenges despite the necessity of human resources and the opportunities for advancement. QuickBooks emerges as a highly effective solution to streamline company accounting systems. Working with a remote bookkeeping service will still provide you with all the value you could get from an in-office bookkeeper but at a fraction of the cost. The skeleton is made up of Vendors, Customers, Employees, Company, & Banking. All of this functionality though doesn’t necessarily mean it’s a time saver for you or your business. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

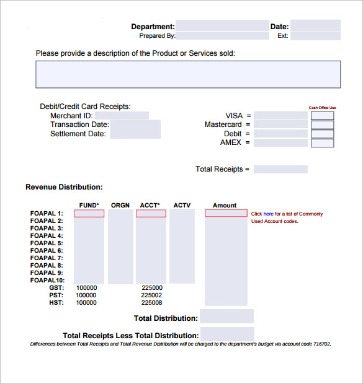

Can you add credit card accounts to your QuickBooks feed?

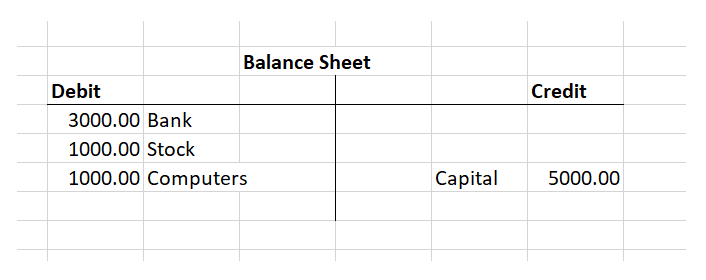

A balance sheet gives a snapshot of your company’s assets and liabilities at any given time. With QuickBooks balance sheet reports, you’ll be able to assess the financial health of your company. Additionally, you’ll have an overview of whether or not your business is growing. From income and expenses to profit and loss, QuickBooks generates financial statements instantly. Just as with a profit and loss, the standard balance sheet is fine, but I recommend pulling the balance sheet detail in QuickBooks to send to your tax preparer.

The liquidity of your company will be illustrated in a statement of cash flows. Your profit and loss statement, also called an income statement, summarizes your business’s financial performance over a period of time — daily, weekly, monthly, quarterly or annually. It is an important document https://www.accountingcoaching.online/contingent-liability-what-is-it-and-what-are-some/ because it tells you the company’s biggest areas of expenditures and revenues. QuickBooks gives you flexibility as to how the statements are used and shared. You can view them in QuickBooks, email them to yourself or another member of the business or export them for later viewing.

Three plans give your business the scalability to grow over time and add features as necessary. The Core plan offers everything a small to midsized business would need to get started, while Premium and Elite plans enable options such as same-day direct deposit and expert assistance with setup. You can set up payment schedules, process checks, initiate direct deposits, and more.

By automatically connecting bank/credit accounts and syncing transactions, QBO reduces manual data entry. Features like autofill and memorized transactions also automate repetitive tasks. QuickBooks provides resources like onboarding material, training videos, and downloadable resource guides to help you start. However, QuickBooks always advocates hiring a professional accountant to oversee your business finances. For example, the software cannot detect errors or alert you if your tax filings are inaccurate. A professional ensures your financial records are both complete and accurate.

There, they can review your numbers and print whatever information they need to submit your return. As QuickBooks tracks income, it will also tell you the number of possible deductions you are https://www.intuit-payroll.org/ eligible for, saving you thousands of dollars every year. Like Xerox is to copies, and BandAid is to bandages—QuickBooks has been synonymous with business accounting software since the 1990s.

You can add checkboxes to your spreadsheet to allow users to indicate the status or selection of specific items. QuickBooks Online also syncs with a variety of payroll tools, including the accountant-friendly QuickBooks upper mohawk inc. cost as an independent variable Online Payroll. While QuickBooks Online users don’t get a discount when signing up for QuickBooks Payroll, the two software products integrate seamlessly with one another and are equally easy to use.

You can calculate and run payroll automatically, based on the pay schedule you set. This significantly reduces the potential for errors and penalties that manual payroll processing might incur. Overall, the benefits of using QuickBooks across various financial functions provide increased efficiency, better decision-making, cost savings, and enhanced collaboration for your business. The reporting feature is the ideal feature that managerial personnel find QuickBooks the most helpful.

- QuickBooks Payroll starts at $45 a month plus $6 per employee paid per month, and new users can choose between a 30-day free trial or 50% off discount just as they can with QuickBooks Online.

- It works best for small companies that need to organize their finances but don’t necessarily have large or complex accounting needs.

- Most QuickBooks users are familiar with the concept of adding checking accounts to their QuickBooks bank feed.

- An income statement, showing your profit margin, allows you to see how well your business is doing and if costs need to be cut in certain areas.

For more about the differences between the two programs, read our comparison of QuickBooks Online vs QuickBooks Desktop. What’s more, you can set up scheduled bill payments in QuickBooks using QuickBooks Bill Pay, a new built-in feature that replaced the Bill Pay powered by Melio integration. Available in QuickBooks Online Essentials and higher plans, QuickBooks Bill Pay allows you to pay bills via bank transfer or check directly from QuickBooks in a few seconds and pay several bills at once.