TOP 10 BEST Bookkeeping Services in Dallas, TX Updated 2024

The company specializes in tax preparation, bookkeeping, tax returns, tax filing, and refund loans. Other services include IRS help, income taxation assistance, and individual tax return guidance. The bespoke nature of Dallas bookkeeping services is perhaps one of their most defining characteristics. Recognizing that each business is unique, with its own set of challenges and aspirations, these professionals offer tailored financial strategies. In a city as economically varied as Dallas, tailoring financial strategies to the unique tapestry of businesses is not just helpful; it’s essential.

Related Searches in Dallas, TX

As a bookkeeper, you may also receive client payments and deposit them at your company’s financial institution. You can contact us anytime if you have questions or encounter a problem with your bookkeeping program. We help company’s financial activities and operations with full range of financial support .

Find an Accountant near Dallas, TX

- As a professional bookkeeper, you would keep track of a company’s financial transactions and record them in the general ledger accounts.

- Carter Group Tax Service is a full-service tax preparation firm located in Richardson employing staff with experience in bookkeeping and tax services.

- Every company, even a small one, requires bookkeeping to maintain a healthy financial position.

- Discover how we can help you have better finances with a personalized demo from a Bench expert, ready to answer all your questions.

Bookkeeping refers to the daily and monthly recording of transactions, including maintaining the ledger, supporting payroll, categorizing transactions, etc. It an involve reporting on, assessing and leveraging financial information (from regular bookkeeping) to help inform business strategy, create financial models and more. With Bench, https://www.kelleysbookkeeping.com/ you get a team of real, expert bookkeepers in addition to software. You’ll always have the human support you need, and a mobile friendly platform to access your up-to-date financials. There are some times that we’ll request documents from you (like account statements or receipts), just to ensure the information we have is correct.

Tax Planning and Preparation

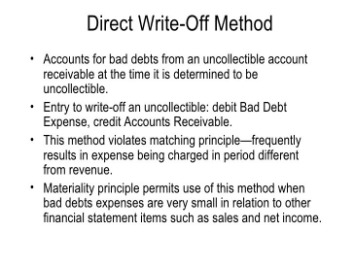

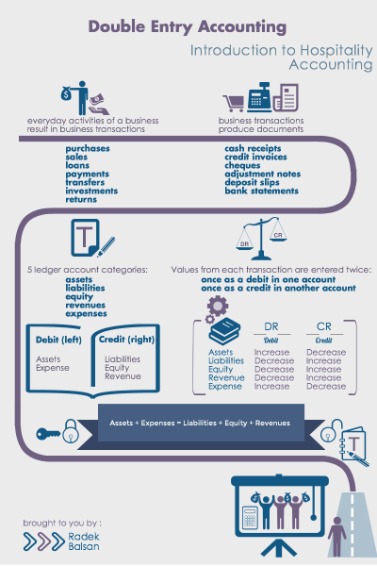

No two clients are the same, and we always ensure each business gets the right services to support their business goals and needs. As a small business ourselves, we know how important cash flow is for companies like yours. Also known as the “Accounting Equation,” the fundamental rule of bookkeeping states that a company’s total assets must equal its liabilities and equity. The Golden Rule requires that every financial transaction be recorded twice. Moreover, it demands that every debit entry have an equal but opposite credit entrance.

Doing payroll on QuickBooks Online and QuickBooks Payroll has saved me so much time, because it is very intuitive and easy to use. QuickBooks and other bookkeeping software give you a tool to do your own bookkeeping. We’ve got experience with every type and will put that knowledge into action by helping make sure everything is set up right from day one so there are less surprises down the line. Hewitt Services considers its role as an experienced and trusted advisor on keeping your business on the right track in an increasingly complex and rapidly changing environment. Once materials are gathered and we have an action plan, then we begin implementation.

Specializing in a career field can help to set you apart and lead to career stability and longevity. You may also be expected to take on more advisory and analytical roles as bookkeeping becomes more automated. As of 2021, approximately 1.7 million people worked as bookkeeping, accounting, or auditing clerks. The BLS expects the field to have a 5 percent decline in growth from 2021 to 2031. Still, you should see 197,600 job openings each year over the next decade [3].

This article is not intended to provide tax, legal, or investment advice, and BooksTime does not provide any services in these areas. This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes. The information presented here may be incomplete or out of date. BooksTime is not responsible for your compliance or noncompliance with any laws or regulations.

Carter Group Tax Service is a full-service tax preparation firm located in Richardson employing staff with experience in bookkeeping and tax services. The company offers tax services, business services, and services for individuals. The firm assists small business with bookkeeping, QuickBooks services, payroll solutions, part-time CFO services, cash flow management, bank financing, business valuation, and more.

We Use Quickbooks, Sage, Zohobook, Quicken, Xero and Other. We look forward to learning about your small business accounting needs. Please take a moment to tell us about what you look for in an accounting firm.We will be in touch to let you know how Jones Square can best serve you. We understand that accounting can add layers of pain and complexity to any business, which is why we make it “EASY” at Jones Square. We are experienced professionals who perform your accounting needs, whether they are large or small, with the highest level of integrity.

Our company will seamlessly integrate your existing services into your newly set-up QuickBooks account and transition your data from offline software to the cloud. This content has been made available for informational purposes only. Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals. Small businesses may prefer to handle their books themselves, but hiring a professional bookkeeper can be helpful. We work with the help of market best software and sync up with your accounts to save time, improve accuracy, and keep your books up to date at all times.

This means that businesses can count on bookkeeping services like ProLedge’s, which are comprehensive and intricately customized to their needs. Tailoring bookkeeping to a Dallas company’s unique needs streamlines finance management and paves the way for savvy growth through sharp financial insight. In the sprawling cityscape of Dallas, where industries thrive, and businesses burgeon, https://www.personal-accounting.org/bond-definition/ the essence of financial management cannot be overstated. It’s here, in this dynamic environment, that the specialized services of local bookkeeping professionals become not just beneficial but fundamentally essential. Diving into Dallas’s booming business scene, it’s clear that teaming up with a sharp bookkeeping pro is key for any company looking to stay ahead of the game.

Accountex is an accounting firm serving personal and business clients throughout the Dallas, Texas, metro area. Other options include forensic accounting, cash flow management, strategic shares outstanding vs floating stock business planning, and tax preparation, planning, and problem-solving. Moses Bookkeeping & Tax Service is a full-service tax preparation and bookkeeping firm located in Rockwall.

If you are local to the Plano/Frisco/McKinney area, we’re happy to meet with you in person or virtually. OOTB can help with a variety of ongoing monthly accounting and bookkeeping needs—including invoicing, bill pay, payroll, 1099s, inventory management and more. If you don’t see the specific package you need above, let us know—we’ll tailor something to your business.